We’re delighted to be involved in Appacus’ Appy Wednesday – our opportunity to introduce ourselves to the Appacus Community.

AccountancyManager is a multi award-winning ‘Onboarding and Practice Management Software’ built by accountants, for accountants.

Why AccountancyManager (AM)?

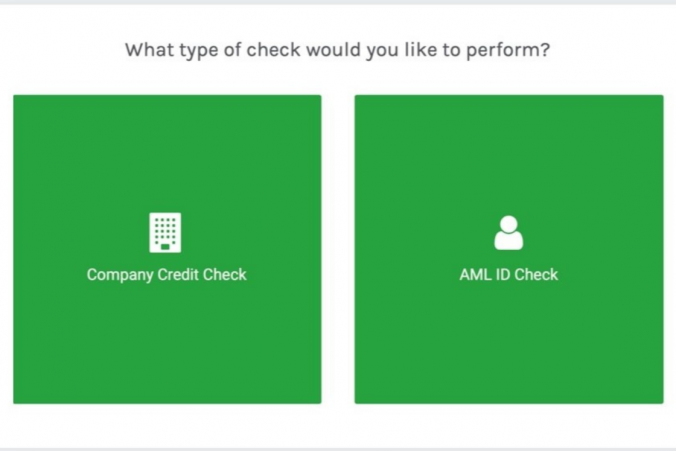

AM has focused on building a solution right from the onboarding process, which includes automatically populated LoEs, e-signing, document storage, AML ID and Credit checks and client portal, right through to task management and client communication via email and text.

Our aim is to automate as many back-end processes as possible to alleviate the administrative burden.

To achieve this, you need to constantly be evolving…

Our development team is a busy bunch. They turn user feedback into features at an impressive speed – we’ve launched seven new releases in the last two months alone. All of our features are aimed at reducing your admin time to zero… because who has time for admin?

Here’s a quick round-up of the brand new features that have made us ‘appy in the last month.

- Bring your credit checks in-house

We’ve added in-system individual and company credit checks, making AM your one-stop-shop for onboarding new clients.

- Automate your VAT payment reminders

Our automation has been enhanced even further, so not only can AM send payment reminders for CT and SA tax, but it can now also send automatic VAT payment reminders. AM will chase your clients for you, so you needn’t lift a finger.