Back in June we ran a webinar on mental health. It attracted a surprising number of attendees and a lot of positive feedback. Although it’s not a topic many people feel comfortable talking about openly, mental health is clearly on our minds.

How are you feeling?

We didn’t make the decision to ask people about their mental health and illness lightly. However, not speaking about mental health only keeps it, and the people suffering, in the dark. Hearing that others feel the way you do, can also be a small comfort – knowing you’re not alone. The more mental health is talked about, the more people can understand their own feelings and those of others.

“1 in 6 adults experiences a common mental health problem, such as anxiety or depression. 1 in 5 adults has considered taking their own life at some point.”

– Mental Health Foundation (2016)

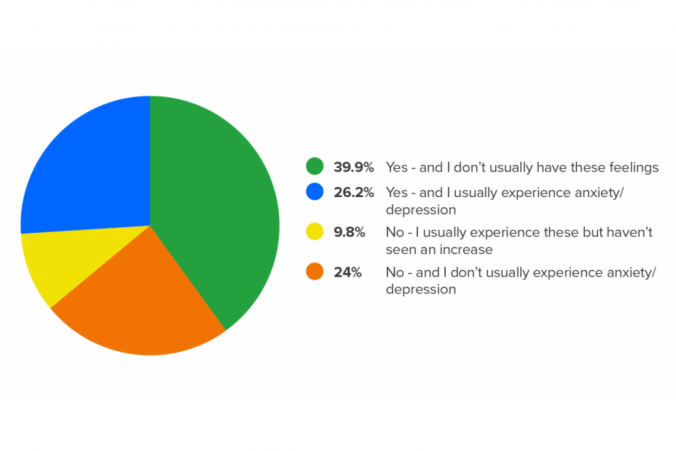

183 accountants and bookkeepers chose to take part in our survey, all anonymously. As the results show, mental health is a very real problem in the accountancy industry and that deserves all of our attention.

93.5% of respondents have experienced higher than normal levels of stress this year

Have you experienced higher than normal levels of stress this year?

We all know accountants and bookkeepers have been under a lot of pressure this year, so the first two graphs won’t come as a surprise. That doesn’t make them any easier to see. A total of 93.5% of respondents have experienced higher than normal levels of stress this year, with 63.4% reporting a significant amount higher.