Your business revolves around your clients. AM revolves around your clients’ information.

Everything that happens across AccountancyManager relies on the data you enter into your Client Import spreadsheet – from your automatically generating Task List to your automated record requests.

The more you fill in, the better AM will be

It might not be fun, but fill in as much as you possibly can. Your life will be much easier going forward and you’ll also get a whole lot more out of AM. Any columns you skip now will mean manually adding data against each client later.

It’s not as daunting as it looks

In this guide, we’ve grouped the columns to help you identify the most important parts to fill in – and why. A good tip is to copy and paste data from existing spreadsheets – or download data from other software you use – to get you started.

We’ll check your spreadsheet over before you upload it

It’s much easier to fix mistakes before you’ve uploaded your spreadsheet. So if you’re at all concerned, just get in touch. Our support team will happily review it for you for free.

Where to find the Client Import spreadsheet template

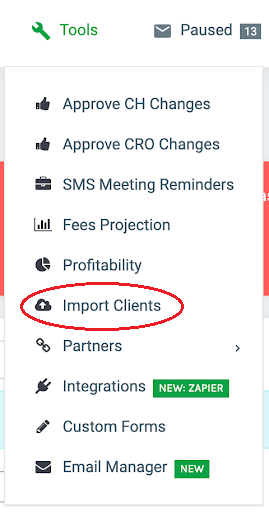

1. Hover over Tools and click Import Clients

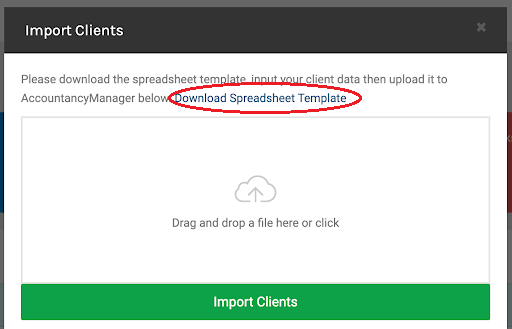

- Click ‘Download Spreadsheet Template’

- Don’t miss the little description notes for each column

When you open up the spreadsheet, take a look at the top of every column. You’ll find a small triangle. Hover over this to see a note explaining the data you need to add and what it affects in AccountancyManager. And now you’re ready to start entering data.