AM Blog

Bright new acquisition, brand and website: BTCSoftware joins the fold

Bright was created in 2021 to unify several best-in-class software solutions with one crucial thing in common – world-class customer support that accountants and bookkeepers can depend on. It’s no secret that Bright has ambitious plans. We’re creating a seamless ecosystem that enables accountants to support their clients efficiently and profitably. To continue expanding our ...

Continue Reading

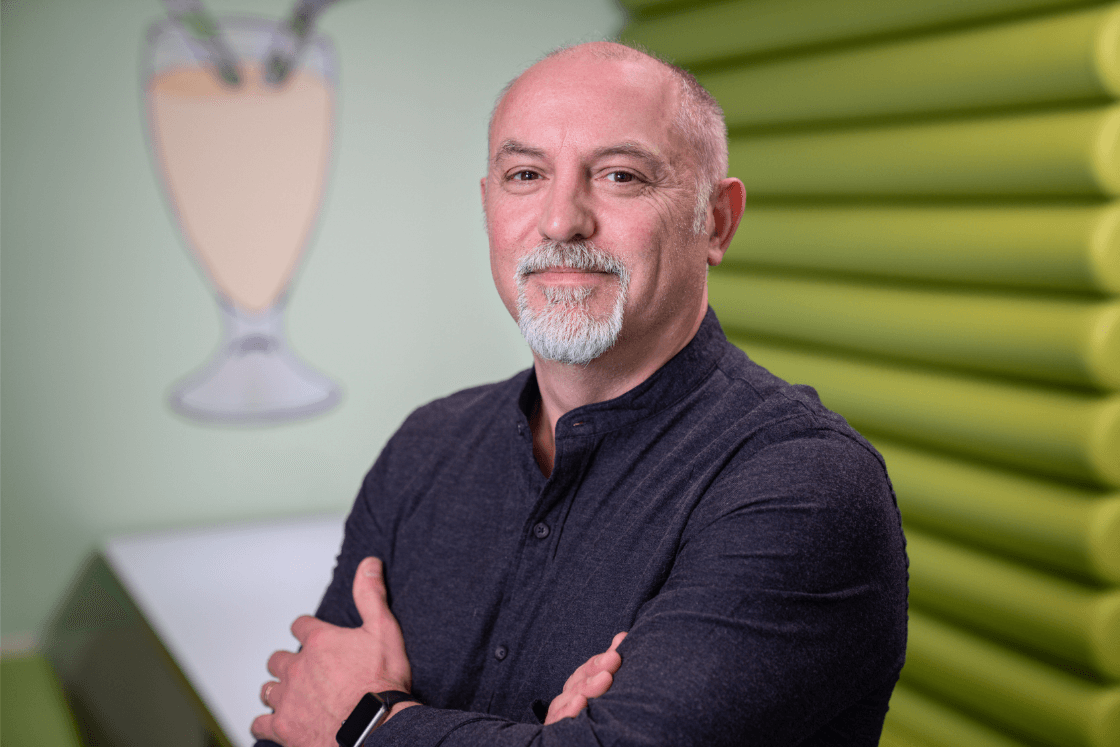

Kevin McCallum takes over as CEO of Bright

Bright Software Group was formed in September 2021, as a result of a merger between BrightPay, a leading provider of payroll and HR software solutions, and Relate Software, a leader in post-accounting and bookkeeping software. AccountancyManager joined the group in March 2022. Bright continues to grow rapidly across the board, and in the latest organisational ...

The ultimate guide to onboarding accountancy clients

The quality of client interactions can make or break an accountancy firm, creating an initial level of trust that has the potential to form a strong working relationship on each side. First impressions count so the onboarding process is a critical stage that will set standards for both parties as to the level of service ...

5 ways client timelines/audit trails are a must-have feature for practices in 2022

Disagreements can arise from time to time with clients. Whether they’ve missed a tax payment or submitted a document that was never signed, it is your practice’s responsibility to ensure that the correct procedures were followed, every step of the way. Of course, it can be difficult to show written records for every single interaction ...

3 ways automated emails can transform your practice

You’re running a busy accountancy practice with a million things on your to-do list – between processing VAT returns and preparing accounts – the last thing you need to be doing is chasing clients for missing information. Writing repetitive emails and requesting records from clients that don’t reply can be frustrating. You might feel like ...

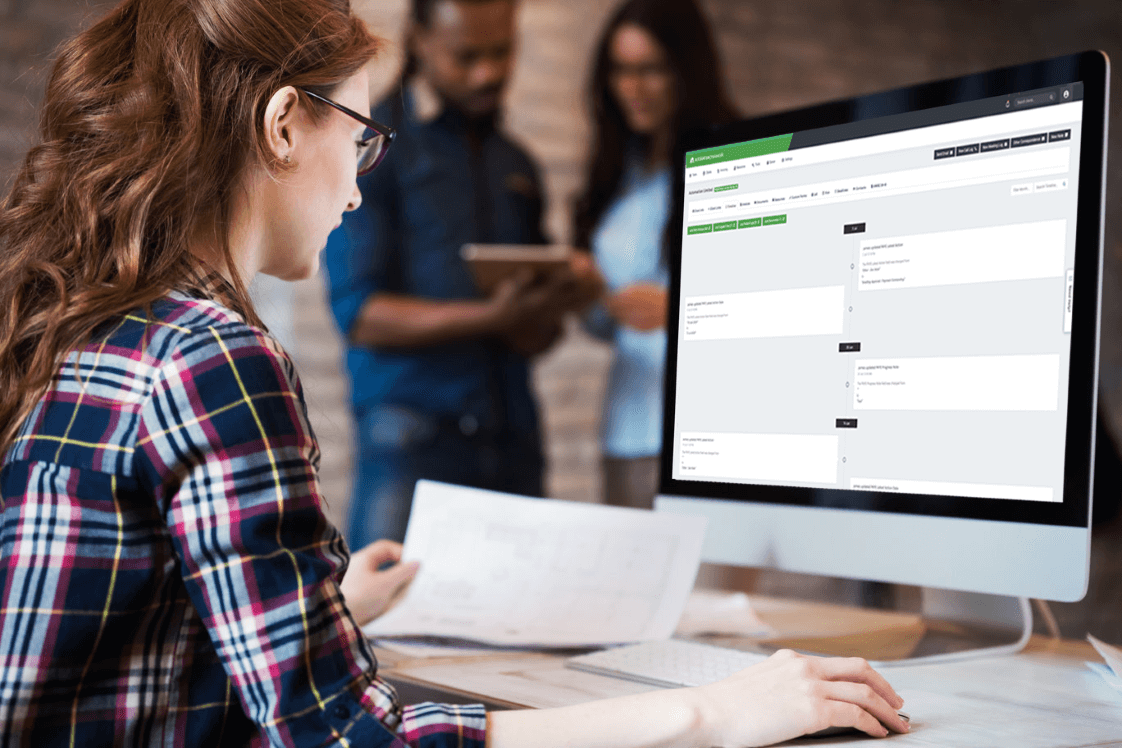

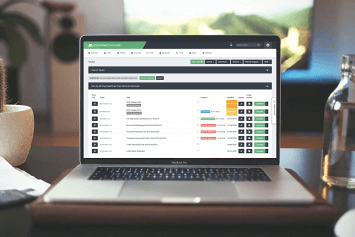

What is practice management software & why do I need it?

For accountancy firms looking to grow their business and streamline their day-to-day processes, practice management software is the solution that could enable you to do that. But what is practice management software? It’s software which can be adapted to an accounting firm in order to cut out those administrative tasks that fill up all of ...

AM joins Bright Software Group

We’re delighted to let you know that AccountancyManager is joining the Bright Software Group (Bright), provider of the BrightPay payroll product, recognised for providing award-winning software to SMEs and accounting firms across the UK and Ireland. James Byrne, co-founder of AM, will continue as a shareholder in the combined group and remain involved with the ...

AM joins Bright Software Group FAQ

What’s happening? On 24th March 2022, AccountancyManager was acquired by Bright Software Group (Bright), provider of the leading BrightPay payroll product. Why Bright? Bright was formed in September 2021 due to a merger between BrightPay, a leading provider of payroll and HR software solutions, and Relate software, a leader in post-accounting, practice management and bookkeeping ...

2021’s Practice Management Software of the Year

It’s official. We’ve only gone and won the 2021 AccountingWEB award for Practice Management Software of the Year. Although it feels weird to be celebrating an award win in February, we’re not complaining. Quite the opposite. For us, awards aren’t just badges for the website or new bling for the office. They’re recognition – from ...

What’s next for AccountancyManager?

Members of our newly rearranged managerial team took part in an interview with XU magazine all about the future of AccountancyManager. Here’s how it went: JB – James Byrne – Chair JR – James Reilly – Product Lead KM – Kevin McCallum – CEO XU: We were excited to hear the news of AccountancyManager’s leadership ...

How to introduce your clients and team to technology

You discover a piece of software, excitedly tell your team and clients about it – and within a week everyone’s using it and thanking you for excellent foresight…if only. Find out how AM users have risen to the challenge of digital transformation and won. You can sell the benefits of using certain technology to your ...

Can technology actually make us more human?

You might be surprised to hear that accountancy and bookkeeping are well ahead of many other industries in terms of technology adoption. So, as a pioneer of the digital age (yes, you), you’re among the first to experience the benefits – and the barriers – of things like automation. One of the biggest concerns, of ...

4 ways to give your business, team and clients a boost

James Byrne, co-founder and CEO of AccountancyManager, started off as an accountant. He created AM to make his life easier – only to arguably make life more complicated by running a software company. AM has grown to 26 people and over 5,000 active users in four years. So what’s his secret? Spoiler alert, it’s all ...

Road map update: Sage, Zapier, QuickBooks, White Labelling and more

Back in February, we boldly announced our 2021 roadmap. Turns out, we had no reason to be nervous. So far this year our development team has smashed out: three big integrations, white-labelling for Client Portals and a few smaller – yet pretty useful – features. Every Wednesday at AM we have a company Zoom meeting. ...

AM Uncovered: Tasks, target dates and stress relief

Last year, we highlighted each of AccountancyManager’s main features in a series of ‘Spotlight’ articles. This year, we hand over the sanitised microphone to the people that use these features, day in, day out. Introducing AM Uncovered, your guide to the best bits of AM, by our users. First up, managing tasks and workflow through ...

AM integrates with Sage Business Cloud Accounting

AccountancyManager (AM) are pleased to announce yet another integration with an accounting software powerhouse – Sage Business Cloud Accounting. Who is AM? AccountancyManager is a multi-award-winning, fully customisable cloud-based practice management software – designed by accountants and used by thousands of accountants, bookkeepers and payroll businesses across the UK. What does this integration mean for you? ...

White-labelling the Client Portal: AM users asked, we delivered

Giving your clients a great experience is probably one of your highest priorities. So it’s one of ours too. With white labelling, you can make the Client Portal look like part of your website. Your branding, your subdomain, not a glimpse of AccountancyManager in sight. With AccountancyManager’s GDPR-compliant Client Portal your clients can access all ...

How to make the most of your free 30-day trial

We know how it is. You sign up for a trial then – before you know it – your 30 days are up. Cue half an hour of panicked clicking around. Wouldn’t it be good if the software company gave you some guidance around how to get a really good understanding of the system during ...

Whoop! You’ve just joined AM. Now what?

On your free trial of AccountancyManager, we recommend trying out every feature. Once you officially join, it’s all about gradually introducing features. We asked AM users how they’ve approached AM adoption. When you start looking for practice management software, it’s probably because you want a better way to do something. So naturally, when you start ...

B1G1 Q1 donation: 58,400 days of access to life-saving clean water

At the end of 2020 we started working with B1G1 to help achieve a better and more sustainable future for all, by making a donation each time a new account joins AccountancyManager (AM). As it’s tough to decide which program to support, each quarter we channel the funds to a different cause, voted for by ...

Appointment of Non-Executive Director

AccountancyManager is delighted to announce the appointment of Kevin McCallum to its board as their first Non-Executive Director. Kevin is Chief Commercial Officer of FreeAgent, the online accounting software platform for the UK’s smallest businesses and their accountants. He has worked within the accounting software industry for over 20 years and joined the FreeAgent team ...

New roles and team members galore at AccountancyManager

Last year was a big one for us, adding 25 new features to AccountancyManager and smashing targets across every team. We started this year in a stronger position than ever, with an ever-growing client base and some pretty exciting plans for 2021. “I couldn’t be more proud of the team and what they’ve managed to ...

AML and Risk: Inside the mind of an HMRC Tax Investigator

HMRC is a notoriously impenetrable institution. So the opportunity to interrogate a former senior tax investigator was too good to pass up. Turns out it was a rather fascinating three hours. John Groves is kind of a big deal. A former senior HMRC tax investigator, he spent 45 years at HMRC and for a time ...

AM’s 2021 roadmap: Integrations, workflow and more

‘An article, on our roadmap? Are you mad?’ When James (Byrne, CEO) asked for this to be written, eyes widened and gasps were heard. Software development times are infamously hard to predict and promising things too early can get us into trouble. When we saw the final list, however, we had to agree – it’s ...

Software that’s as independent as you are

When you’re looking for software to help you manage your practice, you’re likely to come across some familiar names. Global corporations with thousands of employees and multiple kinds of software for different industries. Great. Names you know, with decades of experience. So, why would you entrust the operations of your practice to a four-year-old independent software ...

What do businesses look for in an accountant?

We were chatting recently about what really matters to accountants and bookkeepers, beyond saving time and increasing profits. It was a short conversation. Like us, your clients and prospects are why you do what you do, why your business exists and they’re your future. Healthy client numbers and client businesses are only part of the ...

3 freelancers and their accountant wishlists

We’ve interviewed a number of practice owners now, to see how 2020 has affected them and explore how they work. This week we’ve turned the tables to focus on the one topic that’s been central to every case study so far – your clients and prospects. We want to find out what their top considerations ...

5 quick ways to boost your mental health in 2021

This is it folks, our last article of the year. Before we all bubble-up and (hopefully) turn the computer off for a few days, we’ll leave you with some nuggets of wisdom for taking care of your mental health in the New Year. “Mental health is something that lots of people are talking about more ...

2020 at AM: Our year in numbers

This has certainly been a year none of us will forget, but we wanted to take a step back and try to remember it for what we’ve achieved too. It wasn’t until we saw the numbers that we realised just how busy we’ve been. Not compared to you guys, of course – AM users have ...

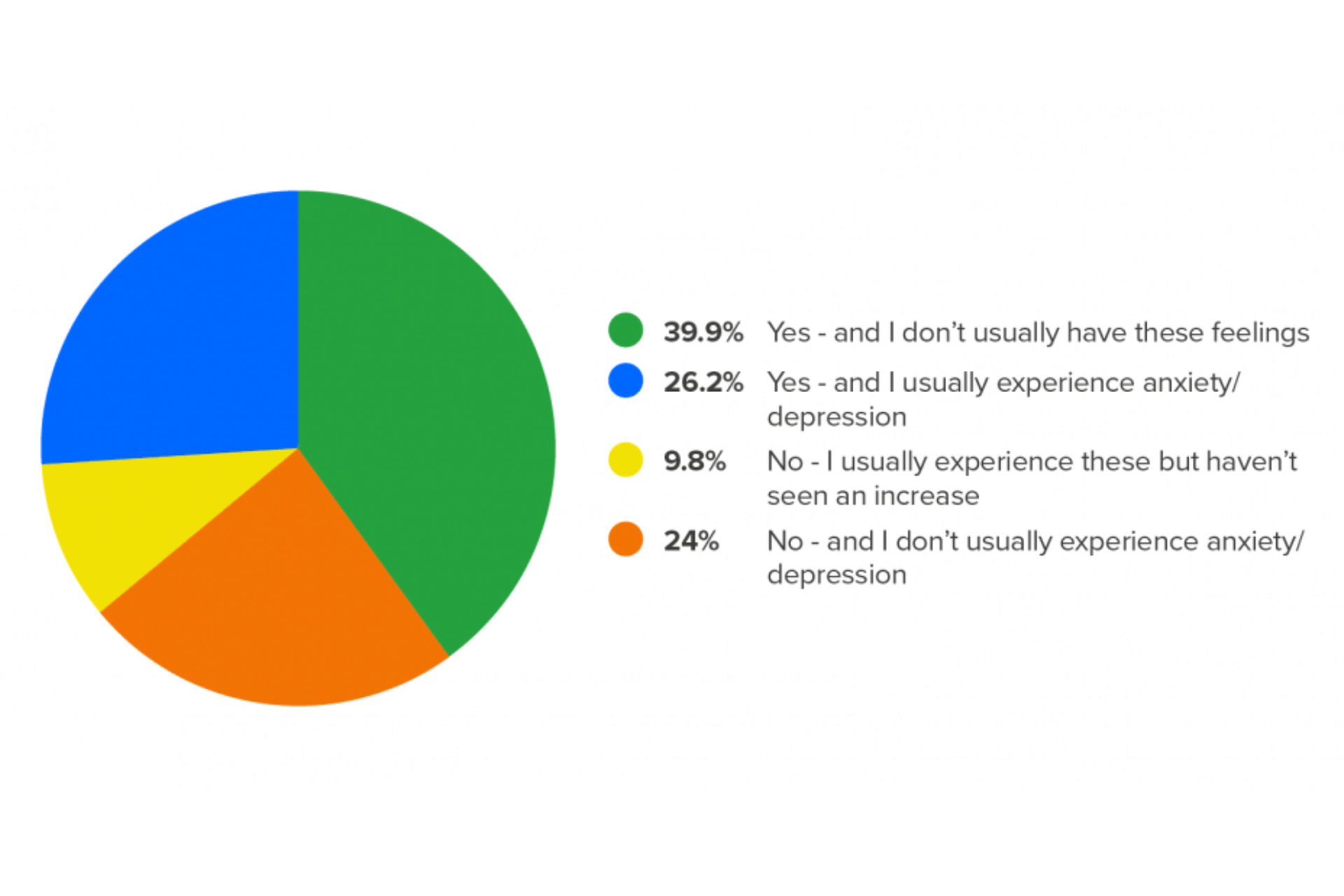

Survey results: Mental health in accountancy right now

Back in June we ran a webinar on mental health. It attracted a surprising number of attendees and a lot of positive feedback. Although it’s not a topic many people feel comfortable talking about openly, mental health is clearly on our minds. How are you feeling? We didn’t make the decision to ask people about ...

Supporting important causes with every new client

We’ve recently been looking into the best way to donate to charity over the long term. This week, after an eye-opening call with Paul Dunn – Co-Founder of B1G1 – James signed up on the spot. Make a difference – just by doing what you do In 2007, B1G1 (Buy1Give1) started with a simple idea: ...

Everything you need for your future, from the start

Over the past few months we’ve been chatting, one-on-one with many AccountancyManager users. They’ve said some lovely things about us, which is nice, but even more interesting has been learning about their journeys from employees to practice owners. Starting your own practice It struck us that AccountancyManager has been a big part of building many ...

AccountancyManager launches the most comprehensive QuickBooks integration

We’re pleased to announce that our hotly anticipated integration with QuickBooks is now live. This will be music to the ears of many AM customers, who’ve been with us throughout the journey from requesting to testing the QuickBooks integration. Thank you for your suggestions and support – we genuinely appreciate it. Client information synced – ...

The A to M of culture and technology

Every business has a culture, whether it’s been purposefully cultivated or not (and we’re not talking about that thing in the office fridge). Summarised as ‘the way we do things around here’, your culture encapsulates how your practice runs, how your people act and what brings you all together. We’ve pulled out the key considerations ...

6 steps to choosing the right practice management system for you

So you’ve decided to join the world of practice management software, but where do you start? We’ve combined our own experience of working with clients with some best practices in change management. 1. Bring your team on the journey Your practice management software is the centre of your practice. Onboarding clients, managing work as it progresses ...

4 ways to cure your Self Assessment headache – now

Every New Year hails the annual scramble to gather Self Assessment information. Millions of people, calculating their expenses, income, interest… for a tax year already fading into memory, as their bookkeepers and accountants send increasingly urgent requests. Yes, the 31st of January is three months away. Yes, you and your clients have quite enough on ...

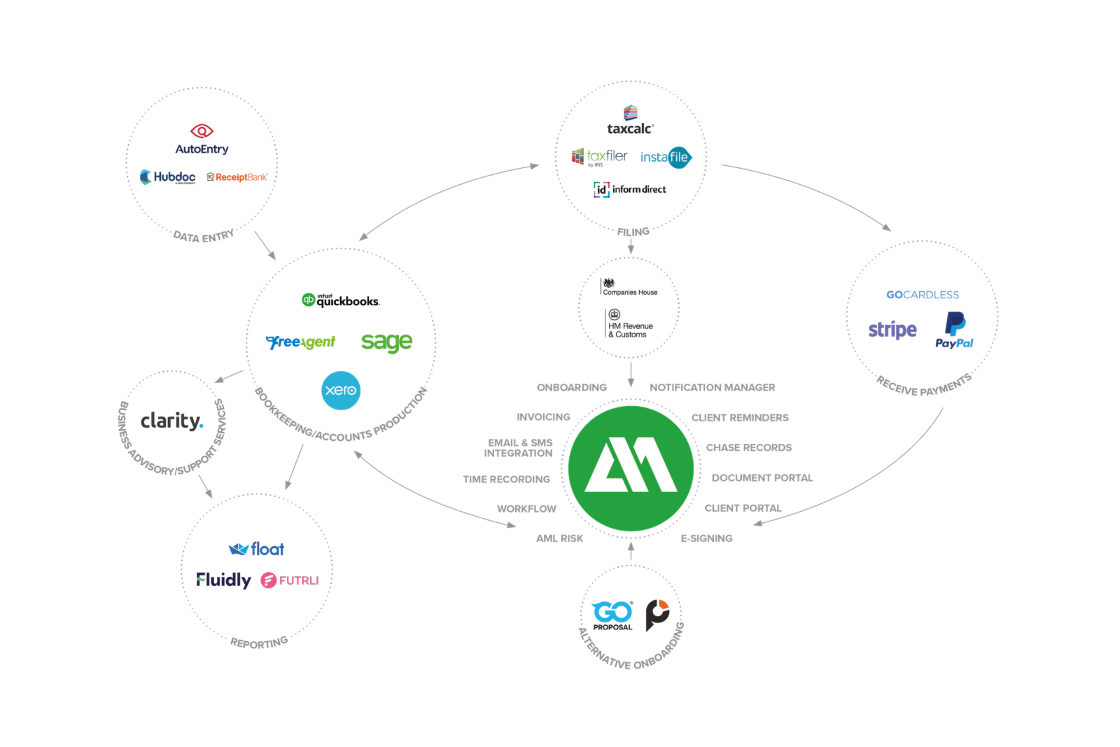

Your 2020 guide to integrated cloud apps

App Stack, App Map, App Flow… call it what you like, combinations of integrated apps is a hot topic right now – and rightly so. All the apps covered here save you time and make life easier for you and your clients. It’s when you combine them that the real magic happens. Powerful automation (within ...

My Internship at AccountancyManager

This article was written by Nach Suphakawanich, our Marketing Intern. A graduate from the University of Birmingham, Nach begins his Master’s degree in Marketing this autumn and is originally from Thailand. A change of plans In July 2020, I graduated from the University of Birmingham with a degree in English Literature. It almost happened without ...

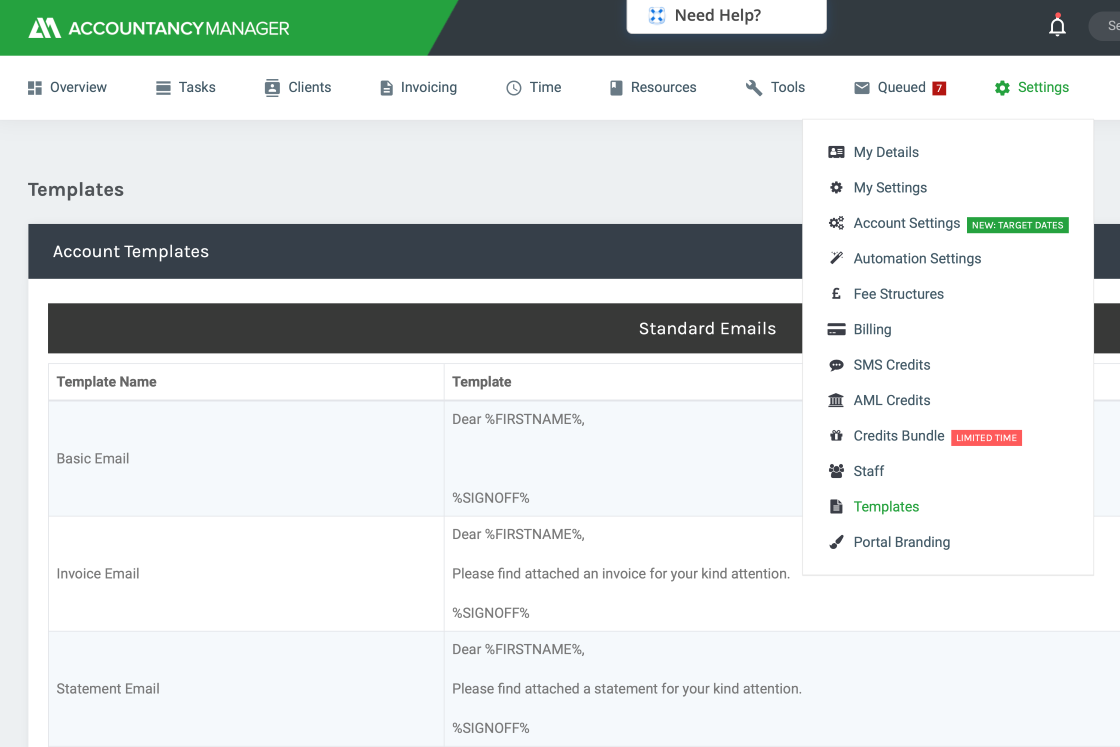

Over 40 email templates. Infinite ways to personalise them.

The number of different emails accountants and bookkeepers send to clients throughout the year is staggering. In fact, cutting out this repetition and wasted time was one of the main reasons James, AM’s co-founder and an accountant himself, created AccountancyManager. Coming full circle, this week’s article has been requested by Nevdish, a new recruit to ...

Appy Wednesday

We’re delighted to be involved in Appacus’ Appy Wednesday – our opportunity to introduce ourselves to the Appacus Community. AccountancyManager is a multi award-winning ‘Onboarding and Practice Management Software’ built by accountants, for accountants. Why AccountancyManager (AM)? AM has focused on building a solution right from the onboarding process, which includes automatically populated LoEs, e-signing, ...

Automated client reminders – and new feature ‘VAT reminders’

The whole point of AccountancyManager is to take as much off your plate as possible, help you organise your practice and free up hours of time. “The time saved with automatic chasing means that we have more time available for our clients.” Sharon, review on Capterra One of the main ways our users save considerable ...

We’re diving into the world of podcasts

From Peter Crouch to Louis Theroux, everyone’s got a podcast these days and we’re excited to be joining them.* We could wow you with our knowledge of 80’s pop music or gardening, but sticking to what we know best, we’ll be shining some light on the issues facing accountants and bookkeepers right now. Join our ...

Client Timeline: A full history and audit trail for every client

Although it doesn’t seem like it at a glance (due to the uncluttered interface) there’s a lot going on in AccountancyManager. Automated emails and texts to your clients, tasks being completed by different people and information and documents flowing in and out of your practice daily. “The amount of client information that you can enter ...

AccountancyManager: Bend it, shape it, any way you want it

We’re often asked ‘is AccountancyManager customisable?’ Think of AccountancyManager like play-doh. It may start off looking the same for everyone, but check back once they’ve added some personalisation and creative flair… Each system will be unique to each practice – and better than how it began. “We’re often surprised by what our users create by ...

Automated task management – now with target dates

The kicker about time, is that it takes time to manage it. You write endless to-do lists, only to reshuffle them when things inevitably change or clients get back to you. With everyone planning their time separately and following different processes, it’s impossible to keep track of job progress or guarantee that the correct procedures ...

We talk mosh pits, brain chemistry, self-worth and curry

Following our first online panel discussion, we invited some of the brightest minds in mental health to join our host Rob Brown and AccountancyManager CEO, James Byrne. As Rob reflected in his closing comments – “It’s been a bit vibrant and edgy and we don’t make any apologies for that, because this is life.” Andrew ...

Transform client processes for future success

With lockdown restrictions starting to ease, what will the future look like and what part will technology play. AccountancyManager has been working in partnership with Alternative Events to deliver a series of Accountancy Hangout sessions. In our recent session the discussion focused on what’s next for the accountancy practice as we delve into how we ...

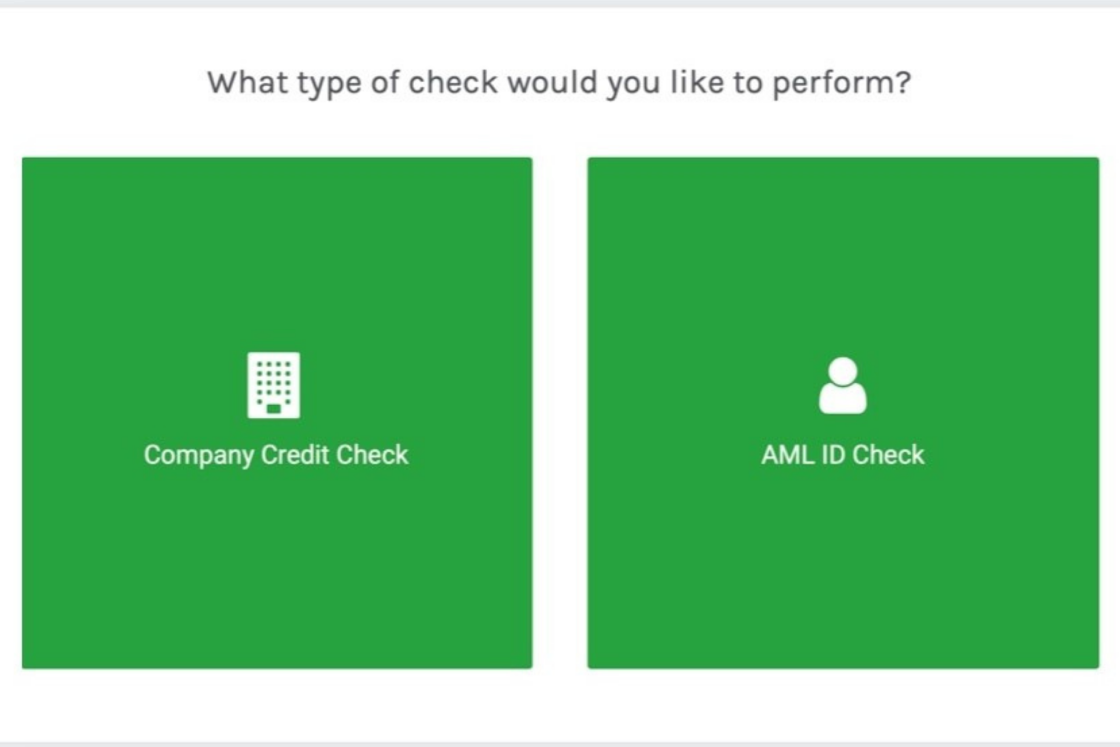

Are these the cheapest AML and credit checks around?

We’re always listening to our customers, but over the last few months we’ve dialled our speakers up to 11. AccountancyManager users have been: telling us about their lockdown lives, requesting new features (in our new user group webinars) and asking – in no uncertain terms – for cheaper AML and credit checks. But we went a ...

Automated emails and texts: Save hours, weeks, months of time

You probably didn’t go into accountancy to write the same client emails over and over again – or endlessly chase for responses. You might be thinking, ‘A 10-minute email? That’s no big deal.’ But let’s do a quick calculation… Take one client. They are VAT registered, complete self assessments and pay PAYE – on top ...

The digital future is here. So what next?

If you haven’t heard of Alternative Accountancy, look them up. We joined a few of their hangouts recently and found interesting topics and polls and some great speakers from large UK firms. While AccountancyManager is designed for small to medium practices, keeping an eye on the likes of Saffery Champness, Kreston Reeves and Grant Thornton ...

Profitability: Powerful data for big decisions

Be honest, do you know exactly which of your clients, services and business areas generate the most profit? As an accountant, you know how important visibility of this data is for your clients, so we apologise in advance if this article preaches to the converted… By using AM, you can track staff costs against client ...

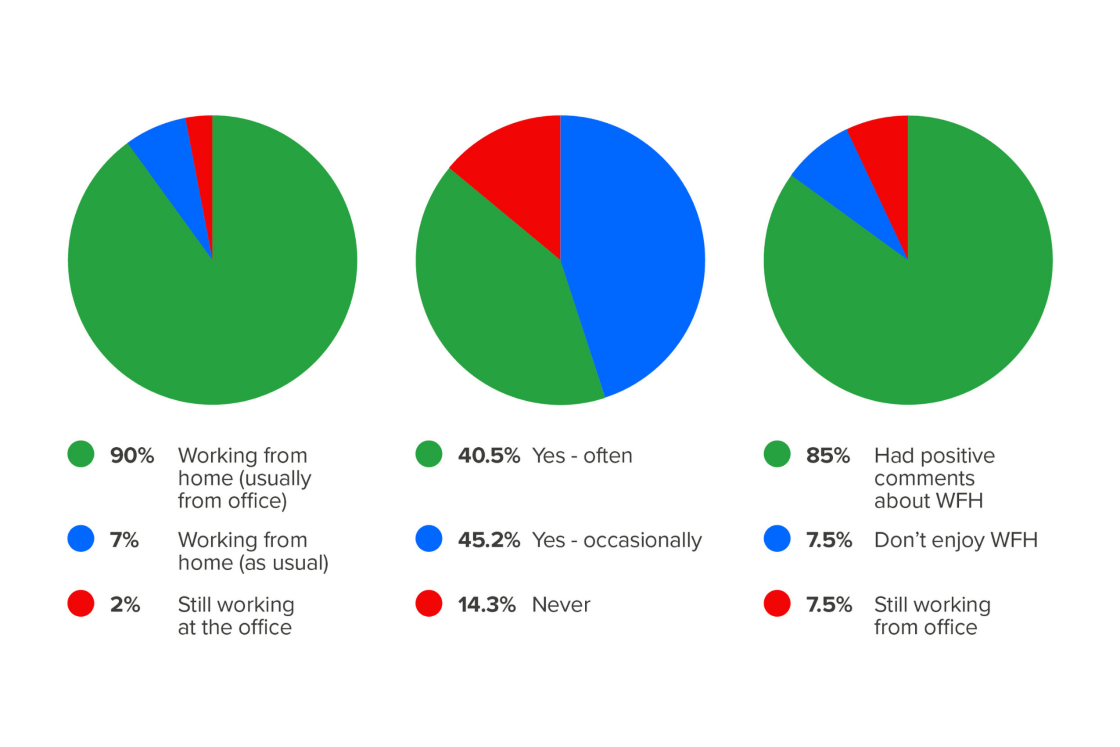

We probe practices on their WFH strategy

Webinars have become the new Marmite. Some love’em, some – not so much. We took the plunge with our first live panel discussion last week and were delighted to have hundreds register. Live online content is just one way technology has stepped up during the pandemic. We asked Rob Brown, host of the popular Accounting Influencers ...

Onboarding: Accelerate your process with intelligent automation

Onboarding new clients was a significant pain point for accountant James Byrne. So much so, he designed a system to automate as much of the process as possible. The result? AccountancyManager. Constantly finding new ways to make onboarding even more efficient for accountants is still a priority for us. In a nutshell, AccountancyManager: Helps you ...

Notifications: Work together or just have a chat

Remember when everyone at your practice was working from the same place? If you needed to update colleagues with new information or ask a quick question, you’d just pop over to a colleague’s desk. The absence of this option makes us realise just how important it is. Working alone can be lonely, but the negative ...

Client portal: A streamlined experience for you and your clients

We recently reported on how AccountancyManager customers have been responding to the lockdown. As we expected there was a direct correlation between the challenges they’re facing, the features of AM that are helping and the spikes we’d spotted in AccountancyManager usage. One challenge was not being able to meet clients in person or get documentation ...

AccountancyManager portal factsheet – for your clients

Rachel, AccountancyManager’s Support Team Lead, has put together the best bits of the client portal from your clients’ perspective – a handy factsheet for you to share. Keep all your documents in one place All of your documents are stored and organised in one place for you to refer to and download anytime. So no ...

Recent SA panic? Get the right client info – fast – with custom forms

Thursday marked the Self Assessment tax return deadline for anyone claiming a coronavirus Self-employment Income Support Scheme grant. HMRC will use data on 2018-19 tax returns submitted by 23 April 2020 to identify those eligible. The Government’s guidance states: (As if you didn’t have enough to deal with.) Use custom forms to get client info quickly and in a digital ...

Stats & facts: Accountants’ lives during lockdown

We’re not the first to say it – the last two months will go down in history. Perhaps it’s a comfort right now to think of our present as the past? Nevertheless, we can all agree, the sooner the coronavirus does become history, the better. As a nation, we’ve become obsessed with statistics. Mapping our journey ...

Xero and AccountancyManager launch full, two-way integration

This news will brighten many a day. Thanks to months of tireless work by our development team, we’re about to see what happens when ‘beautiful accounting’ meets ‘automated admin’. Although you’ll be glad to know – we have a pretty good idea. AccountancyManager joins the Xero app marketplace At 1.44pm on Wednesday this week, Josh ...

Time tracking: 4 ways to get invaluable, practice-wide visibility

Being able to see what your team is working on when you’re all based at home (or when you’re back at the office) gives you a lot more than just ‘peace of mind’. Keep an eye on productivity, track profitability, identify bottlenecks, easily cover absences – and create instant invoices from work in progress. This ...

Bulk emails: Keeping all your clients in the loop

There are a few reasons you might want to send a bulk email to all your clients at the moment: To advise clients on Government support and how to apply To update them on the latest relevant news To provide answers to frequently asked questions To reassure them and show your support To send a ...

Part 3 – COVID-19: How to run your practice from home

In part 1, we looked at preparing your practice for remote working and recommended the best technology for building a virtual office in part 2. In this, our third installment, we focus on the impact of cloud-based practice management software across: Onboarding and data entry Automating client emails and texts Storing and sharing files Internal time management Onboarding ...

Part 2 – COVID-19: How to run your practice from home

Over the coming weeks, most office-based businesses will get their first taste of remote working ‘en masse’. And many will quickly realise that a table, chair and computer do not necessarily make an office. At AccountancyManager, we’re all working from home now – with some interesting new ‘colleagues’… Working together, in the same place, is ...

COVID-19: How to run your practice from home – Part 1

Up and down the country, millions of people (lucky enough to be able to work remotely) are creating makeshift home offices – dragging tables into corners and choosing the right chair. “Businesses and workplaces should encourage their employees to work at home, wherever possible.” – UK Government, Guidance for employers and businesses on coronavirus (COVID-19), 18th ...

Why – in 2020 – there’s no excuse for missing the self assessment deadline

We’ve all heard the ridiculous excuses given to HMRC for not hitting the self assessment filing deadline. But whatever the reasons, real or make believe, it generally comes down to leaving it to the last minute. “More than 700,000 people submitted their tax returns on deadline day. Some 26,562 people completed their returns in the ...

On the hot seat: Another Answer – Large Practice of the Year 2019

While winning our second Luca back in November was fantastic, seeing a customer recognised for their outstanding achievements was even better. We caught up with Sylvia Bourhill, Managing Director of Another Answer, to get her reaction to their win. AccountancyManager: Congratulations on the Luca! How does it feel? Sylvia Bourhill: Just wonderful. I wasn’t expecting it at all, it was ...

6 steps to make self assessment easier on you and your clients

Has the self assessment deadline got you tearing your hair out? AccountancyManager can make it easier on both you and your clients, in six simple steps: 1. Ready-made self assessment checklists Use the template self assessment form provided, make your own tweaks or build custom forms from scratch to collect the client data you need. ...

AccountancyManager’s 2019 – at a glance

It’s January. You’re crazy busy. We’ll cut to the chase. 2019 saw lots of new features introduced to AccountancyManager, 10 new people join us and a few award ceremonies to boot. Now we’re looking forward to making 2020 our best year yet… Ease the pressure of busy season and beyond AccountancyManager automates all your client-chasing ...

Combatting Money Laundering – Part 2

Dishing the Dirt By: Alex Byrne – 22 January 2019 KEY POINTS Tax practitioners should take care to ensure that clients are not tipped off about money laundering reports. Understanding when a suspicious activity report should be made. The difference between internal and external reports. There are limited exemptions from making reports. Advisers should take ...

Combatting Money Laundering – Part 1

By: Alex Byrne – 27 November 2018 Alex Byrne sets out the ways practitioners can protect themselves from the charge of money laundering and looks at published guidance. KEY POINTS Why is money laundering so important to accountants? The application of the rules and examples of money laundering activities. Avoiding committing a money laundering offence ...

Avoid the January Tax Return Chaos – Automate Your Requests and Reminders to Ease Your Workload

Avoid the January Tax Return Chaos – Automate Your Requests and Reminders to Ease Your Workload Happy New Year? For many accountancy firms, January is the most hectic time of year. As the January 31st deadline looms, once again your clients are suddenly rushing to provide you with last minute information as they realise they ...

Saving Time in Your Accountancy Firm

Time is money. In fact, time is actually a mindset, but we won’t get all woo woo on you because if you’re in business then time costs you money. Your employees and even you are costing your business money and if the time spent in and on the business isn’t managed efficiently then you’ll be ...

Automating Your Accountancy Practice (Fed up of Long Hours and Late Nights?)

Whatever field of professional services you’re in, creating the most efficient practice will be a key goal. And with advances in technology, online working and software automation, accounting is moving closer than ever to the nirvana of the efficient automated cloud practice. By driving efficiency through automation you give yourself choice, and that’s something that ...

AccountancyManager Wins the Software Excellence ‘Practice Management’ Award

The Software Excellence Awards, presented by AccountingWEB and hosted by Rachel Riley took place alongside the Practice Excellence Awards at The Brewery in London on 19 October. There were over 30 companies that entered the ‘Practice Management’ category, of those, 5 companies were shortlisted. Over 1,000 votes were placed. AccountancyManager was among the 5 shortlisted and went ...

TaxKings Testimonial

“Signing up to AccountancyManager has been one of the best decisions our practice has ever made. After adapting generic CRM systems to the best of our abilities, AM has been a breath of fresh air and is improving week on week. The fact that the team are friendly, helpful and willing to work with accountants ...

What Our Customers Say

"AM completely revolutionised my practice overnight. I used to spend hours preparing..."

Find out how AM revolutionises practices by signing up today.

Sign up