Being able to see what your team is working on when you’re all based at home (or when you’re back at the office) gives you a lot more than just ‘peace of mind’.

Keep an eye on productivity, track profitability, identify bottlenecks, easily cover absences – and create instant invoices from work in progress.

This is the second in our spotlight series – taking a closer look at the features our customers are finding most helpful while working from home. Read the first – on sending bulk and segmented emails – here.

1. Keep track of who’s working – and on what

See who’s logged into AccountancyManager and what tasks they’re working on in real-time.

Though time tracking has obvious benefits for management, it’s useful data for the team too. We’ve found at AccountancyManager that working from home and juggling things like childcare has meant that our hours have changed a bit. Some of us are splitting our working days with partners for example. Time tracking helps to plan our own time better and make sure we’re spending it on the right things – and in the best way.

Recording your time is easy and soon becomes second nature. Often, your tasks will already be in AccountancyManager – automatically generated according to your clients’ accounting deadlines.

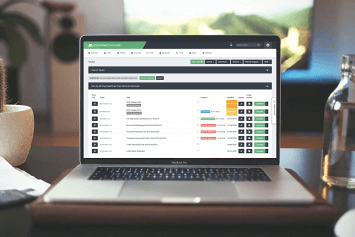

2. Turn logged time into invoices – instantly

See the value of uninvoiced time in your work-in-progress (WIP) log – and generate invoices in a couple of clicks. You can send these invoices to your clients by email, share them through the client’s portal, or send them over to Xero through our integration. AccountancyManager can then chase for payment.